MAKE MONEY BY HELPING YOUR LOCAL BUSINESSES AND ECONOMY!

What is it?

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Now you can earn a full or supplemental income by

helping local businesses in your area

file for ERC, the Employee Retention Credit. ERC is a substantial stimulus available to businesses that

retained their employees

during the Covid-19 pandemic. A company with a minimum of 5 full-time W2 employees can qualify, even if they took PPP loans and had no revenue decrease. When President Biden came into office, he made several changes to the Cares Act legislation, making it

much easier for all businesses to qualify.

How do I do this?

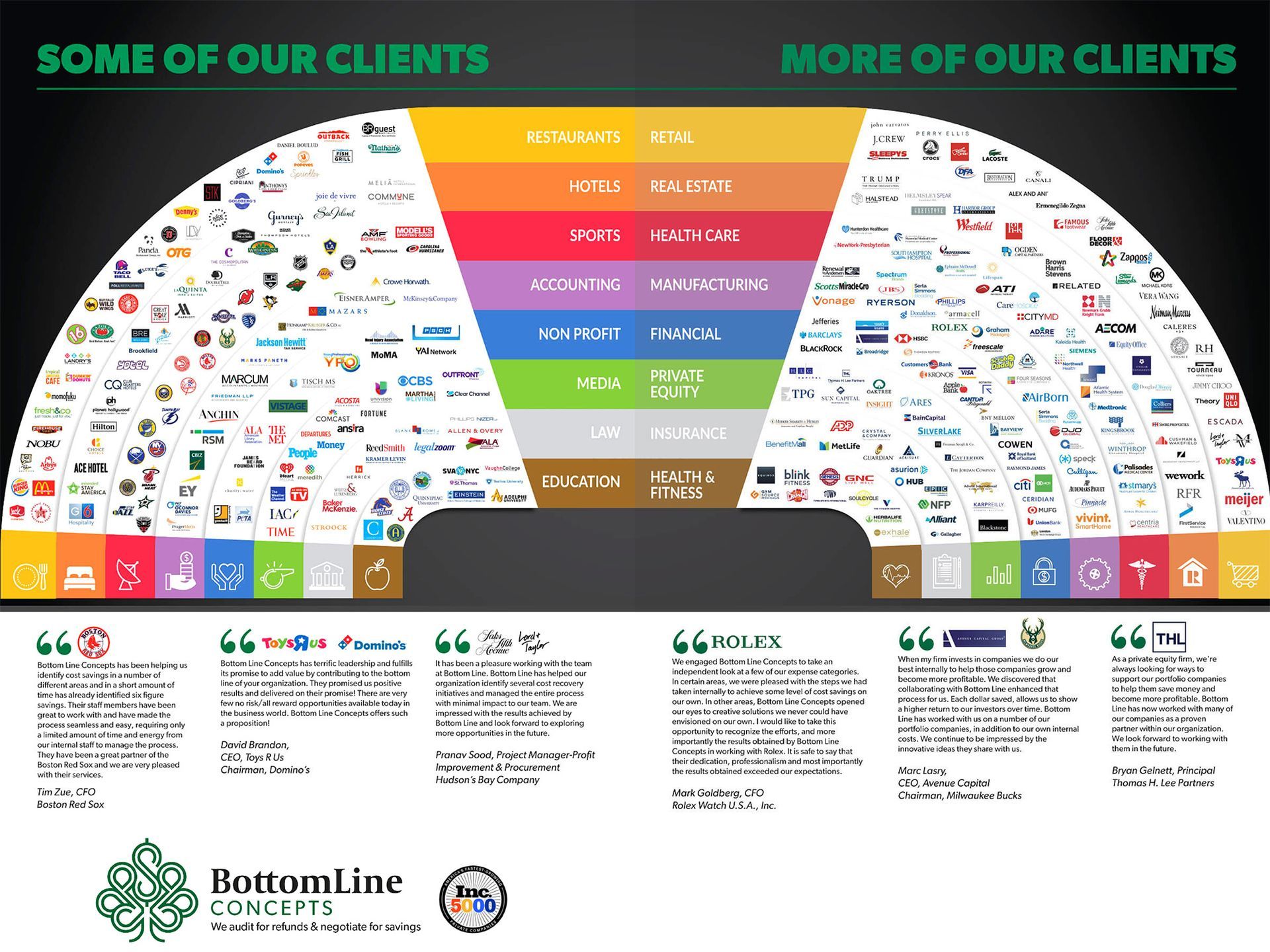

You talk with every business owner in your area in person or by phone and tell them briefly about this limited-time opportunity. You then offer them to sign up for a free 15-minute call with an expert advisor from our partner, Bottom Line. There's no upfront cost for them to signup. Their business can receive up to $26,000 per employee ($10,000 is the average) and you earn a commission once they do! They handle the entire process until the end, and have already recovered over $2.1 billion for over 13,000 businesses such as the following.

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Will I get help to do this?

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Yes! We provide you with the training and the

tools you need to promote this opportunity. You then explore your area to find local businesses that can benefit from the ERC programs. It is a good idea to use a search engine such as

Google Maps to find businesses in your area and to get essential information such as their address and phone number. For best results, it is best to start with

one e-mail,

one phone call, or

one in-person visit. You can ask them basic questions such as what is their industry and how many W-2 employees they have.

How do I get paid?

You get paid after a business has been funded by the government. Once the government approves and funds the business, Bottom Line charges a fee for the service, and you get a commission from it. The commission amount depends on the number of employees of that business and your rank. Most businesses and shops have between 5 and 500 employees.

This is how much you can make with an eligible business that has 100 W2 employees gets approved for ERC.

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

- Bottom Line charges the business 25% of they get from the ERC as the fee for their service, depending on how many W2 employees they have. The average is $10,000 per employee, but it could go as high as $26,000 per employee.

- If a business with 100 employees gets around $10,000 per employee, that's about $1,000,000. (One million dollars)

- Bottom Line charges a 25% fee for their service. That's about $250,000.

- Depending on your rank, you get a 5% to 20% commission on that fee, so you make between $12,500 and $50,000! You work your rank up by earning more commissions.

Time to apply is running out!

Time to apply is expired!

Frequently asked questions

-

What exactly is ERC?

The Employee Retention Credit is basically a tax rebate program for U.S. businesses that were able to retain their employees during the Covid-19 pandemic. It is a refundable tax credit (a grant, not a loan) established by the CARES Act, that you can claim for your business if you qualify. The ERC is available to both small and mid-sized businesses. It is based on qualified wages and healthcare paid to employees.

-

When does the ERC end?

Time is running out. An eligible employer claiming a refundable credit for any quarter in 2020 must file its 941x forms by April 15, 2024. An eligible employer claiming a refundable credit for any quarter in 2021 must file its 941x forms by April 15, 2025.

-

What qualifies as operational changes?

You can ask the business if they had any operational changes. For example:

- Change in business hours

- Partial or full suspension of your operations

- Shutdowns of your supply chain or vendors

- Reduction in services offered

- Reduction in workforce or employee workloads

- A disruption in your business (division or department closures)

- Inability to visit a client’s job site

- Suppliers were unable to make deliveries of critical goods or materials

- Additional spacing requirements for employees and customers due to social distancing

- Change in job roles/functions

- Tasks or work that couldn’t be done from home or while transitioning to remote work conditions

- Lack of Travel

- Lack of Group Meetings

However, it is best to let the expert advisor at Bottom Line work out the details with the business after you refer them.

-

What period does the program cover?

From March 13th, 2020 to September 30th, 2021, for eligible employers.

-

How do I know if a business qualifies?

Not all businesses are eligible, but it is estimated that 70% to 80% of small to medium sized businesses are likely eligible. Help the business sign up for a free 15-minute call with an expert advisor to find out.

-

Why can't they just apply themselves or with a CPA?

Because of the complexity of the ERC stimulus program and its various changes over time, many CPA's and standard accountants do not have the experience or know-how in understanding how this particular program works, whether a business is eligible or what qualifies a business, and how to file for ERC. Just reading about can be 170 pages and the application process can take months to complete. Bottom Line Concepts has streamlined this process and has a proven track record along with the resources to recovering the most funds as quickly as possible.

-

Is this service for free?

Bottom Line works on a contingency basis. There is no fee for this service until the IRS fully funds the business. The business can cover the cost from the funding they get, so they have nothing to lose.

What kind of industries are eligible?

Just about every industry is eligible. These are some of the business that already benefited from the ERC

Watch this video for more information about the ERC:

Time to apply is running out!

Time to apply is expired!

How can the ERC help local businesses?

If a business in your area was open during the Covid-19 pandemic, it probably had to go through some changes. The ERC may help them in a number of ways. Here are a few examples:

Covering operating costs: The ERC may help cover the cost of rent, utilities, inventory, and other necessary expenses that the business incurred while trying to stay open during the pandemic.

Adapting to new circumstances: Many businesses had to pivot their operations during the pandemic to survive. The ERC may help cover the adjustments that were necessary to operate during the pandemic, such as investing in technology for remote work, offering online services, or implementing new safety protocols.

Marketing and advertising: The ERC may also help businesses cover the costs of new methods to market your products or services when traditional advertising channels were no longer effective. For example, to launch a social media campaign or create promotional materials for curbside pickup or delivery options.

Employee support: Many businesses faced the difficult decision of reducing staff or cutting hours during the pandemic. The ERC may provide financial support to help cover all or part of the costs that were necessary to retain or rehire employees, offer hazard pay, or to provide training and resources to help your employees adjust to new safety protocols.

Debt relief: If the business incurred debt during the pandemic, the ERC may help you pay down or refinance that debt, providing much-needed relief and freeing up cash flow for your current and future operations.

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Time to apply is running out!

Time to apply is expired!

Contact Us

Retomart LLC

12210 Montwood Dr

Ste 103 PMB 1084

El Paso, TX 79928-1785

Phone Customer Service Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

To contact us outside of business hours click here